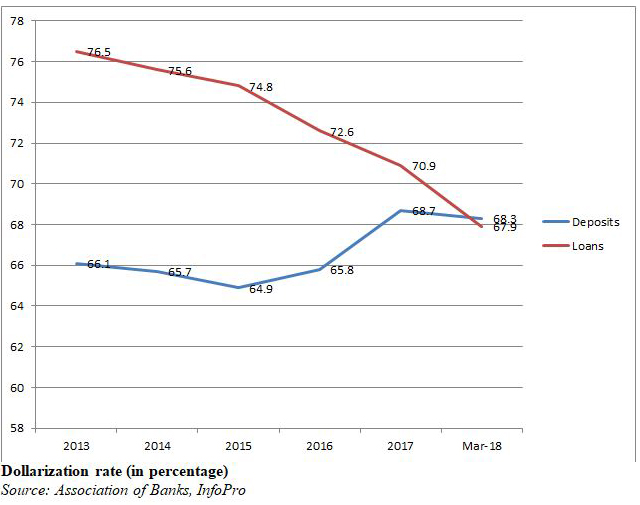

Dollarization rate of loans

drops below that of deposits

First time change driven by conversions to dollar deposits, rise in lira loans

| Share |

|

|

|

|

|

|

|

The dollarization rate of loans dropped below that of deposits in the first quarter of 2018, according to data provided by the Association of Banks.

This is happening for the first time, said Marwan Barakat, Chief Economist and Head of Research at the Bank Audi group.

The dollarization rate of deposits remained at 68.3 percent in April while that of loans dropped further – although slightly – to 67.8 percent.

![]()

The drop in the dollarization rate of loans resulted from an increase in lending in liras thanks to BDL’s stimulus packages, Barakat said.

He said that the increase in the dollarization rate of deposits was driven by conversions to dollar deposits last year. Nearly $3 billion were converted in May before the reappointment of Riad Salameh as Governor of the Central Bank (BDL) and another $3 billion following the resignation of the Prime Minister in November.

According to Moody’s ‘Annual Credit Analysis Report-Government of Lebanon’ released in June, the deposit dollarization rate reached a decade-long peak following the resignation crisis. In order to attract and maintain deposits in the national currency, the banks hiked interest rates on lira deposits by two to three percentage points. BDL also offered incentives to the banks to encourage them to attract lira deposits.

Reported by Shikrallah Nakhoul

Date Posted: Jul 12, 2018

| Share |

|

|

|

|

|

|

|