Interest rate cuts on

subsidized housing loans

Banque de l’Habitat at 4.75 percent Public Corporation for Housing at three percent

| Share |

|

|

|

|

|

|

|

The Central Bank (BDL) has reduced the interest rates on subsidized housing loans and set the end of March as a deadline to start applying the new rates, according to a new BDL circular.

The interest on loans provided by Banque de l’Habitat (Housing Bank) will be calculated on the basis of 20 percent of the interest rate on one-year Treasury bills plus 3.45 percent. This means that the interest charged by the Housing Bank at current rates will be 4.75 percent.

Loans provided through the Public Corporation for Housing (PCH) will pay an interest equal to 20 percent of the rate on two-year T-bills plus 1.6 percent. At current T-bill rates, the PCH loan pays an interest of three percent.

The previous interest rate on both PCH and Housing Bank loans was 5.5 percent.

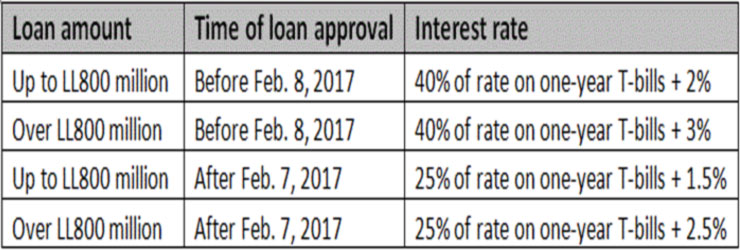

Housing loans provided by commercial banks and that exceed LL800 million ($531,000 at the official exchange rate, nearly $325,000 at street rates) will pay an interest rate equivalent to 25 percent of the rate on one-year T-bills plus 2.5 percent if granted after Feb. 7, 2017.

Source: Central Bank

BDL’s decision to cut interest rates on subsidized housing loans follows reductions in deposit rates and lending rates. The move is part of national efforts to alleviate the interest cost on public debt amid the current economic and financial crisis.

Reported by Shikrallah Nakhoul

Date Posted: Feb 27, 2020

| Share |

|

|

|

|

|

|

|